Diamond Capital Management's Market Commentary

April, 2025

Jeff C. Mantock, CFA, CMT

Vice President, Chief Investment Officer & Manager

Executive Summary:

- Uncertainty related to Trump’s tariffs has sparked higher stock market volatility. Stocks have declined into correction territory, despite the U.S. economy’s resilience.

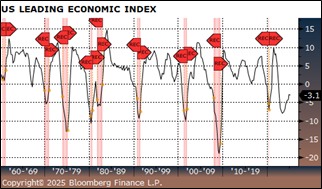

- The chance of a recession in the U.S. within the next 12 months remains low, but an escalated trade war could lead to a sharper global economic slowdown.

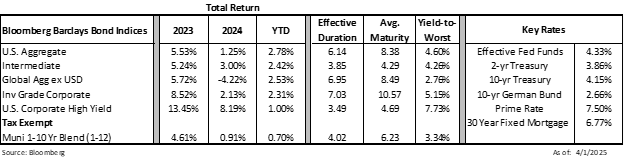

- Sticky inflation will likely keep the Fed on the sidelines until the second half of 2025.

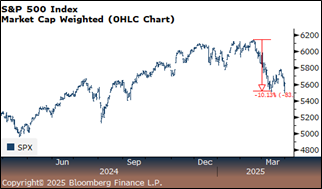

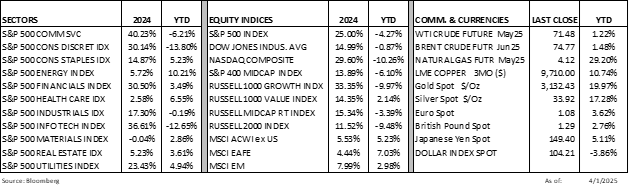

The major U.S. stock indices finished Q1 2025 in negative territory while facing headwinds amid a complex backdrop. The S&P 500 Index experienced a correction, dropping over 10% from its February peak, largely due to uncertainty related to the Trump administration’s new trade policies. Despite this pullback, the U.S. economy remains resilient, supported by solid corporate earnings and a labor market that, while softening, has not collapsed. Although escalating trade tensions could trigger a sharper slowdown or global recession, which may push stocks into a bear market, this is not our base case. We believe domestic equities are more likely to experience moderate growth with the S&P 500 potentially rising 5-8% over the next four quarters. Corporate earnings are expected to grow steadily with S&P 500 earnings per share projected to increase by 8-10% in 2025. While these earnings are down from the double-digit gains in prior years, they should support equity prices.

Nevertheless, the Fed’s cautious approach to additional interest rate cuts in 2025 will keep borrowing costs elevated, favoring larger, profitable companies over smaller, debt-laden firms. Small-cap stocks could lag unless deregulation or lower rates provide a catalyst. The Trump administration’s tariff policies and fiscal agenda will be pivotal. Pro-business policies could boost investor confidence and drive a resurgence in capital markets. Still, a prolonged trade war would likely introduce more volatility, especially in the next couple of quarters, as tariff impacts become more clear. The CBOE Volatility Index (VIX), which depicts implied volatility for the S&P 500 Index and is driven heavily by put option purchases, signifies the recent decline in confidence among investors. The direction of the VIX is inversely related to the S&P 500, and it climbed to an average 20-25 in March 2025.

The U.S. bond market is poised for an extended period of stability, interspersed with bouts of volatility driven by economic data, Fed policy, and evolving dynamics under the Trump administration. Several key factors—interest rates, inflation expectations, economic growth, and Treasury supply—will shape the direction of bond yields and returns over the next 12 months. Treasuries are likely to deliver modest returns with shorter maturities outperforming if the Fed cuts rates and longer maturities lagging due to supply pressure. While high-quality investment-grade corporates can enhance portfolio returns, current credit spreads remain tight and generally unattractive. We continue to maintain a slightly longer duration target compared to our relative benchmarks.

The information and material contained herein is provided solely for general information purposes. This material is not intended to be investment advice nor is this information intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only current as of the stated date of their issue. Certain sections of this publication contain forward-looking statements that are based on the reasonable expectations, estimates, projections, and assumptions of the authors, but forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Investment ideas and strategies presented may not be suitable for all investors. No responsibility or liability is assumed by The National Bank of Indianapolis, or its affiliates for any loss that may directly or indirectly result from use of information, commentary, or opinions in this publication by you or any other person.